Image source, Getty Images

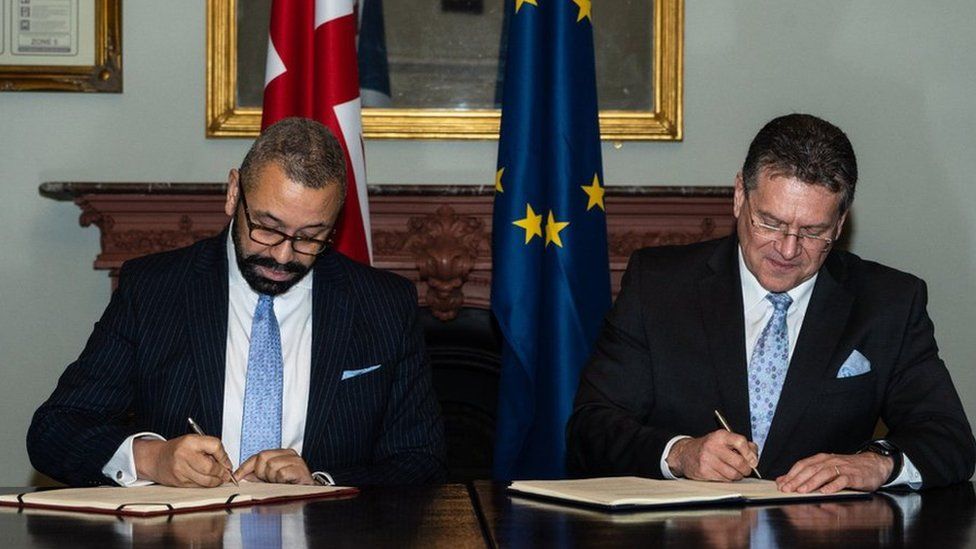

Image source, Getty ImagesThe UK has signed a pact with the EU to increase co-operation on financial services.

It will set up a forum where the EU and UK can meet twice a year to discuss financial regulation and standards.

The long-awaited move is being seen as a sign the UK is willing to work more closely with the EU.

Chancellor Jeremy Hunt said building a constructive relationship was of mutual benefit, as the UK and EU financial markets were “deeply interconnected”.

The memorandum of understanding that is being signed was first outlined in the UK-EU Trade and Co-operation Agreement, in the wake of the UK losing unfettered access to EU markets under Brexit.

The text was published last month, and the memorandum itself amounts to a list of broad shared objectives.

However, describing this as an “agreement” is misleading. It does not mean the UK is committing to align with the EU on regulation, nor conceding to any previous demands Brussels may have signalled, such as moving the processing of some euro-denominated financial instruments out of London.

What it means is that both sides are committing to a regular twice-yearly meeting to discuss “voluntary regulatory co-operation on financial services issues”.

“Both sides will share information, work together towards meeting joint challenges and co-ordinate positions,” the memorandum says.

Daniel Ferrie, a spokesperson for the European Commission, said the move would “set up a forum to facilitate dialogue”.

However, he added: “It does not restore UK access to EU, nor prejudges adoption of equivalence decisions.” Under equivalence, access to the EU can be granted to foreign firms in certain areas of financial services if the rules governing the sector are deemed “equivalent”.

Image source, EPA

Image source, EPAImage caption,

In March, the UK and the EU signed the Windsor Framework, which aims to ease the passage of goods arriving in Northern Ireland from Great Britain by reducing the number of checks needed. The agreement was seen as a sign of improving relations between the UK and the EU.

Coming after the Windsor Framework, the signing of the financial services memorandum is another indication that the UK has become more conciliatory and pragmatic in its approach to the EU than under previous Prime Ministers Boris Johnson and Liz Truss, and may potentially signal more alignment on future regulation. However, any discussion of this is avoided in the text.

Speaking after the signing of the memorandum, Mr Hunt said it was an “important turning point”, while the EU’s financial services commissioner, Mairead McGuinness, said the Windsor Framework had “allowed us to move forward in a spirit of partnership, based on trust, co-operation and delivering benefits for people on both sides”.

“This MoU [memorandum of understanding] we’ve just signed is one example of the benefits of partnership,” she added.

The EU accounted for 37% of UK financial services exports in 2019, and the UK has retained its position as Europe’s most important financial centre post-Brexit, while far fewer jobs have moved than expected, fewer than 10,000.

Chris Hayward, policy chairman of the City of London Corporation, said the signing of the memorandum “sets the stage for a new era of co-operation with our EU partners”.

“We hope this agreement will help ensure both our financial services sectors remain open for business.”

Treasury sources have conceded that the agreement of the Windsor Framework paved the way to get this memorandum over the line. This bodes well for closer working on some of the outstanding parts of the post-Brexit arrangements – not least the tighter rules around rules of origin that are due to come in for carmakers.

But in practice it is unlikely to mean significant changes for financial services in the very near future. The likelihood is there is only time for three forums ahead of the next election.

Related Topics

A simple guide to the Northern Ireland Brexit deal

UK and EU formally adopt new Brexit deal for NI