Summary:

Michaël van de Poppe opined that Mt.Gox’s Bitcoin repayment process wouldn’t tank the marketplace.The defunct exchange was scheduled to reimburse creditors over 100,000 BTC tokens starting this August but further delays emergedNorth of 750,000 Bitcoin tokens was stolen in the Tokyo-based platform in an enormous hack in February 2014.News on the repayment supposedly triggered panic inside the crypto market.Bitcoin traded just above $20,000 on Sunday after dipping below on Saturday.

One crypto proponent surmised that panic inside the virtual currency market is “unwarranted” as Mt.Gox was scheduled to kick off its repayment process involving some 137,000 Bitcoin following a historical hack within the platform back in 2014.

Based in Tokyo, Mt.Gox operated as one of the biggest BTC exchanges of its time. The platform accounted for roughly 70% of all Bitcoin transactions in the height of its power. On Monday, February 24, 2014, the exchange closed its official website following unusual trading activity.

According to reports, a hacker leveraged credentials from a compromised auditor to transfer thousands of BTC to themselves. The event triggered a drastic drop in Bitcoin’s price within the exchange and over 800,000 BTC tokens were stolen, per reports.

The hacked coins were valued at more than $400 million at the time.

Mt.Gox Civil Rehabilitation Plan

A Tokyo District Court approved the so-called Mt.Gox “Civil Rehabilitation Plan” six years after the Bitcoin exchange suffered a massive hack. The plan proposed partial compensation for creditors, per reports.

The repayment plan was scheduled to kick off this August 2022 but the process was delayed.

BREAKING:

Mt. Gox will not be releasing the #Bitcoin, and will delay the distribution, once again.

The entire crypto space was stressing out heavily on this, but unwarranted.

– Michaël van de Poppe (@CryptoMichNL) August 28, 2022

Sentiments inside the crypto community suggested panic and concern over Mt.Gox customers dumping their reimbursed BTC bags and further tanking the crypto market. At press time, the total crypto market cap hovered above $1 trillion after a risk-on rally in previous weeks.

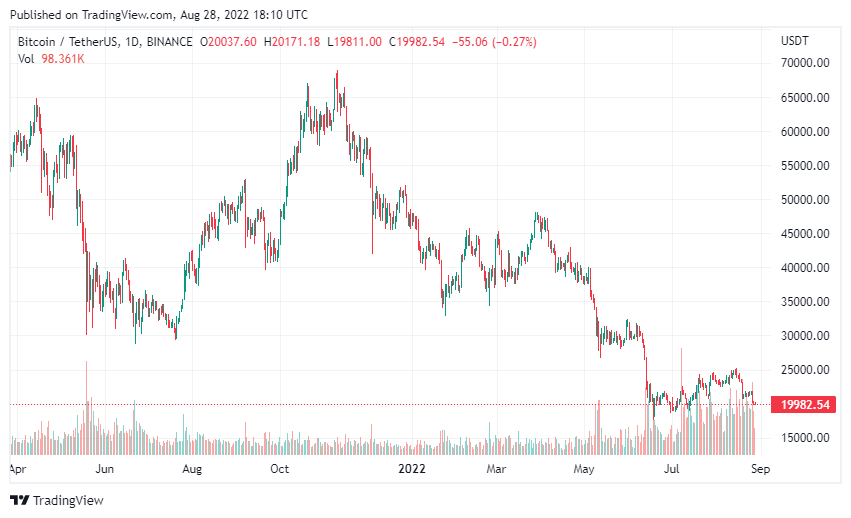

Bitcoin also struggled to stay above the $20,000 level after briefly falling below over the weekend.

Total Crypto Market Cap (Source: CoinMarketCap)

Total Crypto Market Cap (Source: CoinMarketCap)  BTC Daily Chart (Source: TradingView)

BTC Daily Chart (Source: TradingView)

However, technical analyst Michaël van de Poppe pointed out that fear over Mt.Gox Bitcoin was “unwarranted”. Poppe stressed the terms of the rehab plan and how the process could take months to complete.

The fear around the release of, potentially, the Mt. Gox #Bitcoins is just unwarranted. Typical crypto.

– Michaël van de Poppe (@CryptoMichNL) August 26, 2022