Switzerland’s SEBA Bank has launched an Ethereum staking service for institutional clients.The lender is fully regulated and says clients have already been requesting staking services.Ethereum staking and the amount of validators also have hit all-time highs.

Switzerland’s SEBA Bank has launched a staking service for institutional clients, in the same way Ethereum’s Merge is defined to occur. The lender published a news release on September 7 saying that it suits demand from institutions who show fascination with such services as staking and DeFi.

The bank’s staking management platform allows clients to stake on a number of protocols, including Ethereum, Polkadot, and Tezos. It plans to include support for added protocols in the foreseeable future.

Speaking over the demand for these services along with the Merge itself, SEBA Bank’s Head of Technology & Client Solutions Mathias Schütz says,

“The Ethereum merge can be an anticipated and significant milestone with the world’s second largest cryptocurrency, delivering improvements because of its users over the regions of security, scalability and sustainability. The launch of your Ethereum staking services will enable institutional investors to experiment with an integral role in securing the continuing future of the network, with a trusted, secure and fully regulated counterparty.”

The SEBA Bank is really a crypto bank that’s fully regulated and a multitude of solutions, including trading and credit services. With staking on Ethereum, it hopes to create in institutional clients who want to help secure the network.

Ethereum Staking Numbers Reaching New Highs

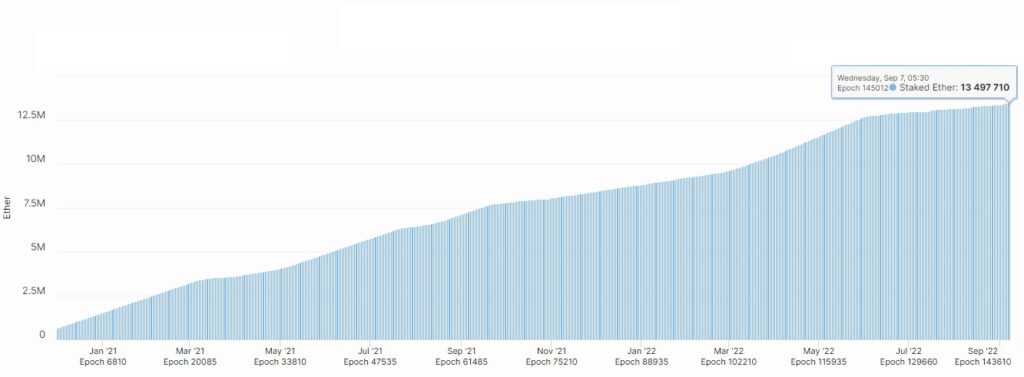

As Ethereum is ready to become Proof-of-Stake network, the amount of validators and staked ETH has reached all-time highs. Daily active validators are now at over 421,000, as the quantity of staked ETH reaches nearly 13.5 million.

Staked Ether: beaconcha.in

Staked Ether: beaconcha.in

Several analysts have already been discussing the impact of this Merge on the price tag on Ethereum, numerous seeing an excellent run with the asset in the years ahead. Evan Van Ness, a prominent figure in the crypto space, said on Twitter that Proof-of-Stake offers economic security, saying that the cryptocurrency could withstand around $25 million in monthly sell pressure.

With PoW, for the purchase price to not decrease:

* $ETH needs ~$600m monthly in new capital

* $BTC needs ~$600m monthly in new capital

With PoS, soon after the Merge for the purchase price to not decrease:

* ETH needs 0 new capital

* ETH may take around ~$25m monthly sell pressure

– Evan Van Ness 🐼 ➡️ 🐬 (@evan_van_ness) September 6, 2022

He also mentioned another important point that ETH staking rewards can be liquid soon, that may bring more stakers on board. This will add additional buying pressure as well.

The next few days are going to bring intense discussion about the future of Ethereum. The prospects look good at the moment, with a major upgrade tantalizingly close and more important ones coming up over the next few years.